EU taxation data sharing under DAC7

If you manage a short-term rental property in a European Union (EU) member state, or if you or your company are domiciled for tax purposes in an EU member state, this article contains important information about new regulations and reporting requirements being introduced by the EU on January 1, 2023.

Terminology:

“Property manager” means a private person or company using Your.Rentals to manage short-term rental bookings for accommodation.

“Property listing” means an individual fixed accommodation unit a Property manager makes available for short-term rental via the Your.Rentals platform.

“Sales channel(s)” means the OTA platforms to which Your.Rentals connects and may make your Property listing(s) available for booking (such as Airbnb, Booking.com, VRBO, Expedia etc).

“OTA booking” means a booking facilitated by a Your.Rentals connection to a Sales channel.

“Direct booking” means a booking made using Your.Rentals direct booking features; ie. it is not an OTA booking.

“Resident” - the country in which a person or company is “resident” for DAC7 purposes means the country in which the person or company has their primary residence and, in addition, any other country in which the person or company has been issued with a tax identification number (TIN).

“DAC7” means the EU Council Directive 2021/514, which requires online platforms such as Your.Rentals and connected Sales channels to collect and report taxpayer information on Property managers who earn income from short-term rental bookings.

“Reportable seller” means the individual or company who receives the income from the rental of the Listing accommodation.

1. General information about DAC7

What is DAC7?

DAC7 is a directive on cooperation between different EU member states on gathering and reporting data about natural and legal entities and their earnings through digital platforms and marketplaces. One of the focus areas covered is the rental of fixed property, which includes short-term / vacation rentals.

To whom does DAC7 apply?

DAC7 applies to a platform user (in this case a Host or Property manager) who receives income from renting accommodation, where the user is either a resident of an EU Member State or the income is received from a Property listing in an EU Member State.

Does Your.Rentals or a sales channel’s obligation to share data apply to my listing?

If you have a listing for a property located within one of the EU’s 27 Member States or you are resident in an EU Member State, your data may be shared with the relevant country or countries. If you have a tax identification number (TIN) in a country other than your main country of residency, the information may also be shared with the tax authority in the country that is not your main country of residence.

Is this a one-time request, or is it a continuing reporting obligation?

DAC7 reporting is an annual reporting obligation. Your data will be shared each January for all income and information during the previous year. DAC7 is effective from January 1, 2023, and your information in respect of the calendar year 2023 will be shared in January 2024.

What data is required to be shared with the EU tax authorities?

Under DAC7, a platform operator is obligated to report the taxpayer information for Property managers who have a rental activity or receive income in the relevant reporting year via the tax authority of its Member State of residence.

For property managers using Your.Rentals, depending upon the source of the booking the Platform operator may be the Sales channel or Your.Rentals.

2. How does DAC7 impact me?

If you or the property owners that you represent qualify as a Reportable seller, you must provide Your.Rentals with the required taxpayer information for the Reportable seller for each property listing.

DAC7 is effective from 1 January 2023. If Property managers do not provide the required taxpayer information, Your.Rentals will be required to freeze payouts and in some situations may pause or unlist property listings. In some cases, the policies of individual Sales channels will determine the impact of not providing Your.Rentals with the taxpayer information.

To ensure there is no impact on your listings remaining online in Sales channels, receiving bookings and processing payouts, it is important that Property managers provide the relevant information to Your.Rentals as soon as possible.

3. What is a Reportable seller?

The “Reportable seller” is the person or company that receives the rental income.

After a booking is made by a guest, Sales channels and Your.Rentals “pass-through” the rental income, deducting fees for their services. The “Reportable seller” is the person or company who receives the rental income at the end of that chain.

The taxation information for a Reportable seller must be supplied for each Property listing.

To determine who is the Reportable seller for each of your listings, you can use the following decision tree.

Summary:

If you own the property and are renting it yourself using Your.Rentals, you are the Reportable seller if the property is located within the EU, and/or you are resident in an EU country for taxation purposes.

Summary:

- If you are a Business managing rentals of property which other people own, and you have a fixed rental agreement with the owners i.e. paying them a fixed monthly rent] and you account for the rental income in your company accounts - then your company is the Reportable seller if the property is located within the EU, and/or your company is registered in an EU country for taxation purposes.

- If you are a Business managing rentals of property which other people own, and you have a commission agreement with the owners i.e. you pass through the rental income to the owner less your commission] - then the property owner is the Reportable seller if the property is located within the EU, and/or the owner (private person or company) is resident or registered in an EU country for taxation purposes.

4. What taxation information must be provided?

Your.Rentals needs to collect the “Reportable seller” information below for each property listing, and provide it either to a Sales channel who is a Platform provider, or to the Member States taxation authorities via the Danish Skattestyrelsen.

The following information will be shared with the relevant Member States taxation authorities, depending upon the Reporter seller:

|

Individual taxpayer information |

|

|

Company taxpayer information |

|

|

Booking and income information (for either Individual or Company) |

|

5. Who reports taxation information?

For some Sales channels (such as Airbnb and Expedia), Your.Rentals must provide the Sales channel with the Reportable seller taxation information so that they can report it to the tax authority of their Member State of residence.

For other Sales channels and in the case of Direct bookings processed via Your.Rentals, Your.Rentals must report your taxation information to the Danish Tax Agency (Skattestyrelsen) who in turn will share your information with the relevant authorities in other EU Member States...

6. How do I provide my information?

You are required to provide Reportable seller information for each Property listing that is published on a sales channel.

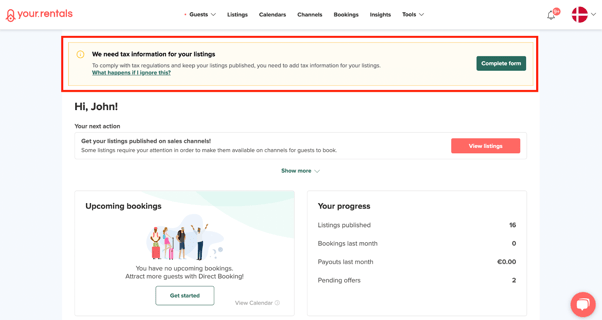

Your.Rentals will send notifications, emails, and messages asking you to provide the Reportable seller information for each of your Property listings.

Please note: Taxpayer info is required to be assigned to all of your listings that are published on a sales channel. You may continue to receive reminders until all listings have tax info assigned.

Below, you will find a step-by-step guide on how you can provide your tax information at Your.Rentals.

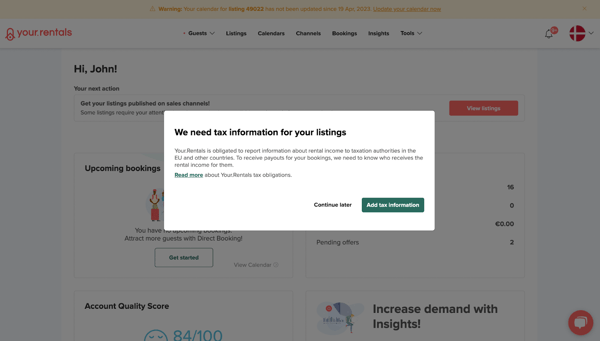

When you login to Your.Rentals, you will see the following pop-up window:

To start the process and add the tax information of your listings, follow the steps below:

- Click on “Add tax information”.

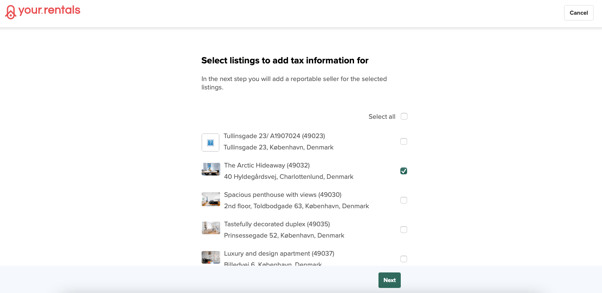

- Next step is to select the listings (all of your listings that are located in the EU).

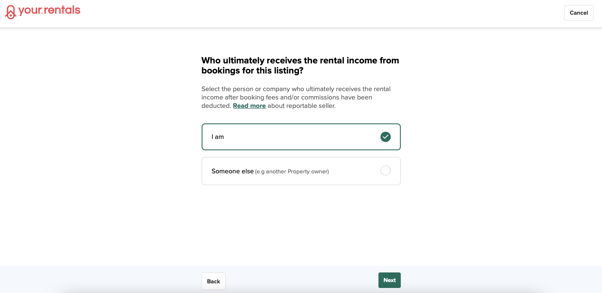

- Next, you will have to provide information on who receives the rental income from the listings. In other words, who is the reportable seller.

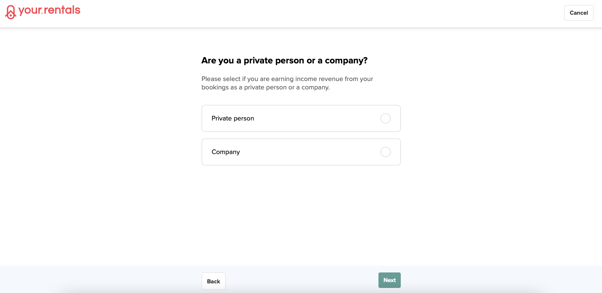

- The following step is to declare whether the reportable seller is a Private person or a Company.

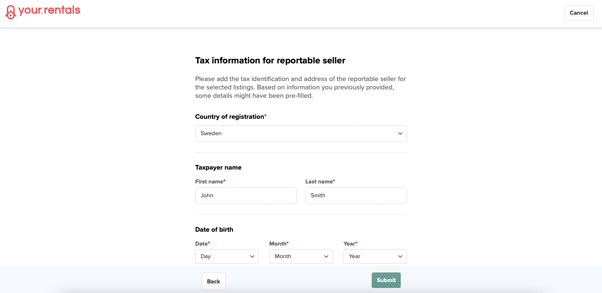

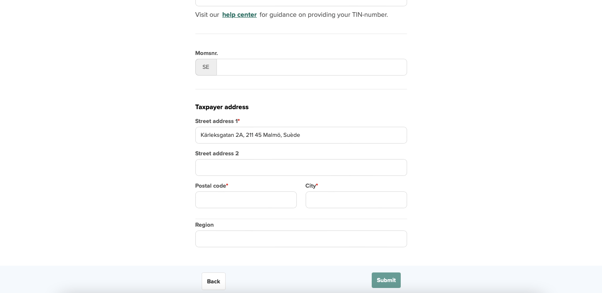

- Then, the last step is to report the tax information:

- In case of Private person as reportable seller:

- Name

- Date of birth

- Address

- Tax Identification Number is not mandatory but if the country issues this - you need to provide it.

- In case of Company as reportable seller:

- Name of company

- Address of company

- Tax Identification Number & VAT is not mandatory but if the country issues this - you need to provide it (all EU countries should).

- Fill in the form accordingly and then click “Submit”.

Example: tax information form for Private person

Please note: Tax information is required to be assigned to all of your listings. If you do not provide the tax information, you will see a notification on the website that we need your tax information. To get paid out for your bookings, please ensure that all your listings have a reportable seller added and you provide the tax information for each Property listing that is published on a sales channel. Please provide this information by clicking on “Complete form” in the notification box.

Please note: We are requesting the tax ID used for income tax purposes, not VAT. Each country’s expected tax ID format for Individuals and for Companies are listed below based on OECD guidelines. Consult your local tax advisor to confirm.

Individuals

Country |

Individual |

Company |

||

|

Known as |

Format |

Known as |

Format |

|

|

Austria |

Steuernummer |

9 digits |

Steuernummer |

9 digits |

|

Belgium |

Numéro d'identification du registre national |

11 digits |

Numéro d'entreprise |

10 digits |

|

Bulgaria |

Единен граждански номер |

10 digits |

Единен идентификационен код |

9 digits |

|

Croatia |

Osobni identifikacijski broj |

11 digits |

Osobni identifikacijski broj |

11 digits |

|

(Republic of) Cyprus |

Αριθμός Φορολογικού Μητρώου |

8 digits + 1 letter |

Αριθμός φορολογικής ταυτότητας |

8 digits + 1 letter |

|

Czech Republic |

Rodné číslo |

9 digits |

Identifikační číslo |

“CZ” + 8 digits to 10 digits |

|

Denmark |

CPR-nummer |

10 digits |

Det centrale virksomhedsregister |

8 digits |

|

Estonia |

Isikukood |

11 digits |

Äriregistri kood |

8 digits |

|

Finland |

Henkilötunnus |

6 digits + (+ or - or “A”) + 3 digits + 1 digit or letter |

Yritys- ja yhteisötunnus |

7 digits + “-” + 1 digit |

|

France |

Numéro fiscal de référence / Numéro SPI |

13 digits (first digit is always 0, 1, 2, or 3) |

Numéro SIREN |

9 digits |

|

Germany |

Identifikationsnummer |

11 digits |

Steuernummer |

10 digits to 13 digits |

|

Greece |

Αριθμός Φορολογικού Μητρώου |

9 digits |

Αριθμός Φορολογικού Μητρώου |

9 digits |

|

Hungary |

Adóazonosító jel |

10 digits |

Adószám |

11 digits |

|

Ireland |

Personal Public Service Number |

7 digits + 1 letter 7 digits + 2 letter |

Tax reference number |

7 digits + 1 letter 7 digits + 2 letter “CHY” + 1 to 5 digits |

|

Italy |

Codice fiscale |

6 letters + 2 digits + 1 letter + 2 digits + 1 letter + 3 digits + 1 letter |

Codice fiscale |

11 digits |

|

Latvia |

Personas kods |

11 digits |

Komersanta reģistrācijas numurs Latvijas Republikas Uzņēmumu reģistra komercreģistrā |

“9000” + 7 digits “4000” + 7 digits “5000” + 7 digits |

|

Lithuania |

Asmens kodas |

10 digits or 11 digits |

Juridinių asmenų registro kodas |

9 digits or 10 digits |

|

Luxembourg |

Nationale identifikationsnummer |

13 digits |

National Identifier |

11 digits |

|

Malta |

Numru ta’ identifikazzjoni personali |

7 digits + 1 letter 9 digits |

Unique Taxpayer Reference Number |

9 digits |

|

Netherlands |

Persoonsnummer |

9 digits |

Rechtspersonen Samenwerkingsverbanden Informatie nummer |

9 digits |

|

Poland |

Numer identyfikacji podatkowej |

10 to 11 digits |

Numer identyfikacji podatkowej |

10 digits |

|

Portugal |

Numero identificação fiscal |

9 digits |

Número de identificação de pessoa coletiva |

9 digits |

|

Romania |

Cod numeric personal |

13 digits |

Codul unic de identificare fiscală |

2 digits to 10 digits |

|

Slovakia |

Rodné číslo |

10 digits |

Identifikačné číslo |

10 digits |

|

Slovenia |

Enotna matična številka občana |

8 digits |

Davčna številka |

8 digits |

|

Spain |

Número de identificación fiscal |

8 digits + 1 letter “L” + 7 digits + 1 letter “K” + 7 digits + 1 letter “X” + 7 digits + 1 letter “Y” + 7 digits + 1 letter “Z” + 7 digits + 1 letter “M” + 7 digits + 1 letter |

Número de identificación fiscal |

1 letter + 8 digits 1 letter + 7 digits + 1 letter |

|

Sweden |

Personnummer |

10 digits |

Organisationsnummer |

10 digits |

7. FAQs

1. I host multiple listings in one country. What information do I need to provide?

DAC7 requires taxpayer information to be provided for each property listing. The same taxpayer information can be assigned to multiple listings. You can also add different taxpayer information for different listings.

2. I host listings in multiple countries. What Information do I need to provide?

DAC7 requires taxpayer information to be provided for each property listing. It is expected that you will have relevant taxpayer information, such as a tax identification number (TIN), for each country in which you host property listings, or are a resident.

Note: If you host listings within and outside of the EU, the request for taxpayer information under DAC7 is independent of taxpayer information obligations you may have in other countries.

3. I am not the property owner of my listing. What information do I need to provide?

If you manage a property on behalf of a property owner, and the rental income is paid out directly to the property owner or you pass through the rental income, then you should provide the taxation information for the property owner. If you earn the income and pay the property owner a fixed amount for the property (fx. On a monthly basis), then you must add your taxation information.

4. If I don’t provide my taxpayer information and assign to listings, will Your.Rentals share my data?

Yes. We will share all of the relevant information that we have, to the extent required by DAC7, in addition to taking the required enforcement measures of freezing payouts and/or blocking the ability to list your properties.

5. If I am not an EU resident Property manager, will my data be shared?

Yes, if you have a property listing in the EU. DAC7 applies to any Property manager (individual or company) with an EU property listing, regardless of where the Property manager is resident.

6. Can the Tax Authorities review my income tax returns for past years?

The rules applying to the review of prior tax returns vary by EU country. Countries may have a particular period after filing a return during which they are entitled to review that return. Consult with your local tax advisor for further information.

7. If I deactivate my Your.Rentals account now, will my information be shared?

Your information will be reported if you rented a property via Your.Rentals for any part of a year from 2023 or earned income from any Property listing in circumstances where you are an EU resident for the purposes of DAC7. For example, if you accepted 1 booking for April of 2023, and deactivated your account afterwards, we will report your 2023 information up until the point of deactivation. If you deactivate your account in advance of 2023, your details will not be reportable.

8. What if I don’t provide my taxpayer information?

If you do not provide the required information Your.Rentals will be required to freeze payouts and in some situations may pause or unlist property listings. In certain cases, the policies of individual Sales channels will determine the impact of not providing Your.Rentals with the taxpayer information.

To ensure there is no impact on your listings remaining online in Sales channels, receiving bookings and processing payouts, it is important that Property managers provide the relevant information to Your.Rentals as soon as possible.

9. What is the legal basis for collecting my data? (Data protection rights)

What is the legal basis for collecting my data?

DAC7 (Council Directive (EU) 2021/514) places a legal obligation on Your.Rentals to share the data of platform users who receive income from renting properties where either the user is a resident of an EU Member State or the income is received from a property listing in the EU. We are collecting your data in order to allow us to comply with our legal obligations under DAC7.

Who will Your.Rentals share my data with?

Your.Rentals will share your data with the Danish Skattestyrelsen for DAC7 compliance purposes. The Danish Skattestyrelsen will then share this data with the tax authorities in the EU Member State(s) where you are resident and/or where your property listing(s) are located.

What will happen if I do not provide my tax information to Your.Rentals?

If you do not add the information within the relevant timeframe, we will freeze payments to you and/or block your ability to publish property listings and receive bookings via the Your.Rentals platform.

I do not have a Your.Rentals account – will Your.Rentals collect my data for DAC7 purposes?

In some circumstances Your.Rentals will collect certain tax information even if you do not have a Your.Rentals account. This will happen where you are earning an income from a property listing in Your.Rentals platform, and the person who is registered with a Property manager account on Your.Rentals has provided your data to us. Please see our Non-user DAC7 Privacy Notice for more information.