Reporting to taxation agencies

If you manage a short-term rental property in certain countries, Your.Rentals and the Sales channels we distribute your Property Listings to are required to report your taxation information to local taxation authorities.

Note: If your Property listing(s) is located in one of the 27 EU Member States, or if the “Reportable seller” is resident in an EU Member State for taxation purposes, please refer to the specific article relating to the DAC7 requirements.

Which countries require Your.Rentals to collect your taxation information?

Your.Rentals supports taxpayer info collection in the following countries:

- Europe

- All 27 European Union (EU) Member States [DAC 7 specifics here]

- Norway

-

- Canada

- United States

- Mexico

- Colombia

- Asia

- India

If your property listing is located in one of the countries listed above, or if you are resident in one of those countries for taxation purposes, Your.Rentals requires you to submit taxpayer information in order to list your property, receive bookings and payouts.

Whose taxation information must be provided?

Taxation authorities in these countries require information about the person or company that earns income from renting properties (we refer to them as the ”Reportable seller”).

Your.Rentals must collect your taxation information to comply with our responsibilities as a Platform operator, and provide such information either to Taxation authorities or to Sales channels who themselves act as Platform operators and in turn must provide such information to Taxation authorities.

The following decision trees help you to determine who is the “Reportable seller” and therefore who’s taxation information must be provided by you for each Property listing.

What taxation information must be provided?

The following information must be provided and will be shared with the relevant Taxation authorities depending upon the Reporter seller:

|

Individual taxpayer information |

|

|

Company taxpayer information |

|

|

Booking and income information (for either Individual or Company) |

|

Who reports taxation information?

For some Sales channels (such as Airbnb and Expedia), Your.Rentals must provide the Sales channel with the Reportable seller taxation information so that they can report it to the relevant Taxation authority.

For other Sales channels and in the case of Direct bookings processed via Your.Rentals, Your.Rentals must report your taxation information to the relevant Taxation authority.

How do I provide my information?

If your Property listing(s) is located in one of the countries listed above, you are required to provide Reportable seller information for each Property listing that is published on a sales channel.

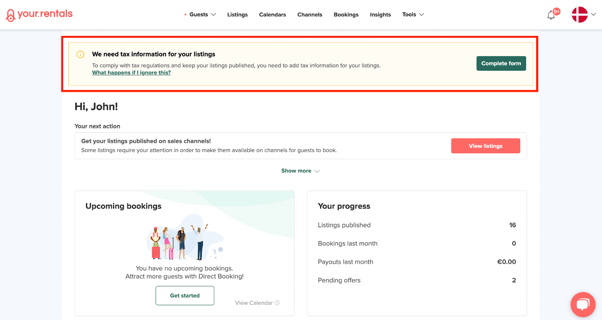

Your.Rentals will send notifications, emails, and messages asking you to provide the Reportable seller information for each of your Property listings.

Please note: Taxpayer info is required to be assigned to all of your listings that are published on a sales channel. You may continue to receive reminders until all listings have tax info assigned.

Below, you will find a step-by-step guide on how you can provide your tax information at Your.Rentals.

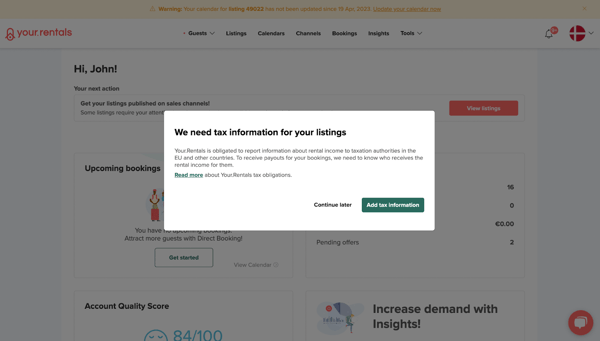

When you login to Your.Rentals, you will see the following pop-up window:

To start the process and add the tax information of your listings, follow the steps below:

- Click on “Add tax information”.

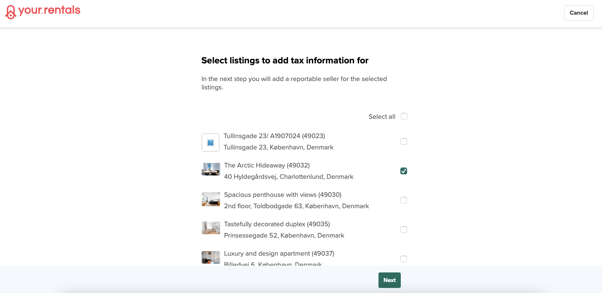

- Next step is to select the listings (all of your listings that are located in the EU).

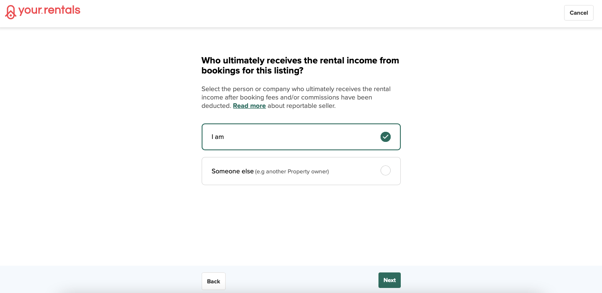

- Next, you will have to provide information on who receives the rental income from the listings. In other words, who is the reportable seller.

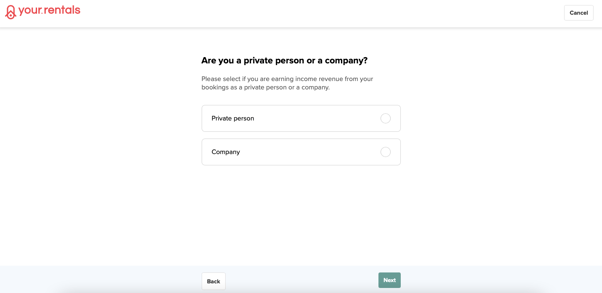

- The following step is to declare whether the reportable seller is a Private person or a Company.

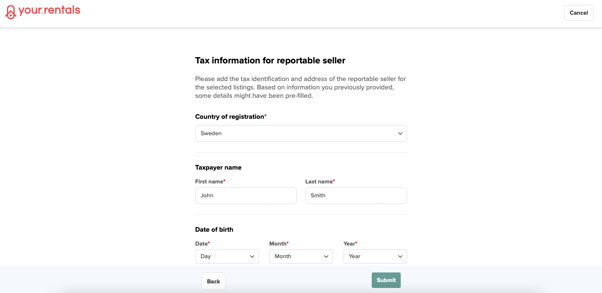

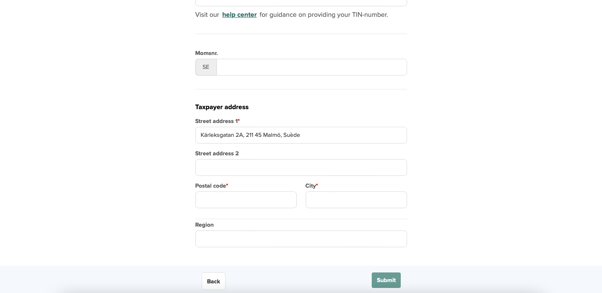

- Then, the last step is to report the tax information:

- In case of Private person as reportable seller:

- Name

- Date of birth

- Address

- Tax Identification Number is not mandatory but if the country issues this - you need to provide it.

- In case of Company as reportable seller:

- Name of company

- Address of company

- Tax Identification Number & VAT is not mandatory but if the country issues this - you need to provide it (all EU countries should).

- Fill in the form accordingly and then click “Submit”.

Example: tax information form for Private person

Please note: Tax information is required to be assigned to all of your listings. If you do not provide the tax information, you will see a notification on the website that we need your tax information. To get paid out for your bookings, please ensure that all your listings have a reportable seller added and you provide the tax information for each Property listing that is published on a sales channel. Please provide this information by clicking on “Complete form” in the notification box.